Lendingkart couples the available data with a machine learning algorithm to equip lenders with an advanced system that assesses risks and approves loans at a much larger scale and lower costs.

MSMEs (Micro, Small and Medium Enterprises) has been a significant contributor to India’s GDP, manufacturing output, and exports. However, despite this huge impact of MSMEs on the Indian Economy, the sector is always crippled by the lack of access to credit

Analytics India Magazine spoke with Abhishek Singh, the Chief Analytics Officer at Lendingkart, to understand how the company is leveraging machine learning algorithms with digital data to develop alternative underwriting mechanisms for the MSME sector.

“As the majority of businesses in this segment are from the unorganised sector, barely possessing any recorded financial history, they have to resort to informal sources to address their financial requirements suited to their business model. As a result, they end up paying higher rates on loans borrowed, clogging their business growth, and even keep high collateral for these loans,” said Singh. “They form a part of the underserved segment by the traditional financing industry as the models and approach to evaluating the segment’s creditworthiness is not suited to the business models and cycles.”

A recent media article has highlighted the massive credit gap in the MSME sector. Only 16% of MSMEs in India receive formal credit, leaving more than 80% of these companies under-financed or financed through informal sources.

Machine Learning To The Rescue

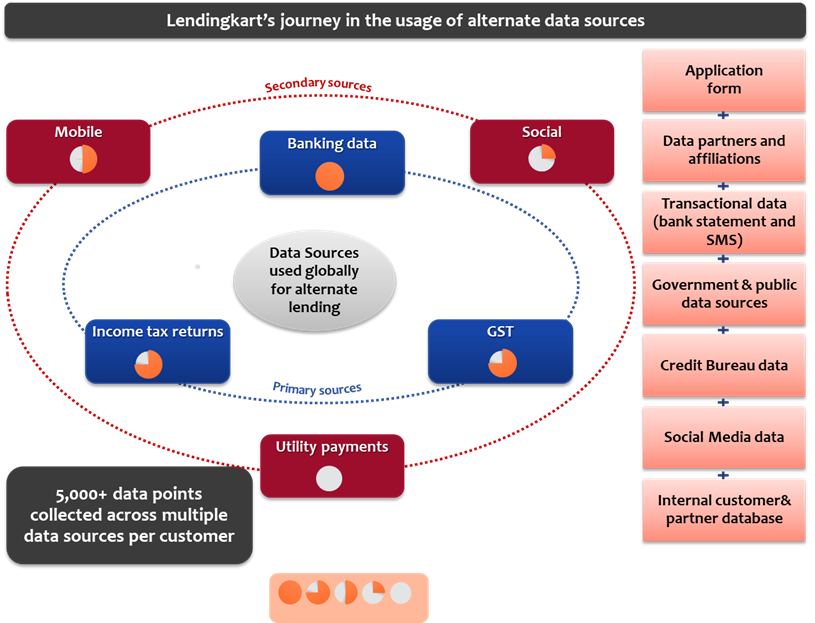

To solve the problem, Lendingkart has developed an alternative underwriting mechanism based on alternate customer data, including bank data, social media data, and GST data. Coupling the available data with a machine learning algorithm equips lenders with an advanced system that assesses risks and approves loans at a much larger scale and lower costs. As a result, the company has been able to reduce credit decisioning time and is ensuring access to financial service for a customer without any delay in processing.

Singh said: Lendingkart pioneered the Cash Flow-based Lending System by developing algorithmic underwriting models which includes customer details and information during the application, credit bureau data, and cash flow data compiled through bank statements. The algorithm ingests the three types of data and creates 5,000+ derived variables. These variables include aggregate variables (min closing balance months, max credit months, wallet share by FIs), trended variables, negative variables (no. of cheque-returns, credit decline, written off), momentum variables (QoQ / HoH/ YoY growth/decline in balances), and balance transfers triggers.

The company uses advanced machine learning techniques and an open-source software library, XGBoost, with an explainability feature. The Lendingkart scoring platform, on the other hand, is a platform-as-a-service, hosted on AWS and developed using Python. It uses the Apache Kafka framework for real-time scoring and involves a slew of different services, including A/B distribution, insurance APIs, amount policy configuration etc. “The average time to score an application is approximately 3.5 secs,” said Singh.

After a comprehensive model development journey — from manual interventions to closing the feedback loops to automated underwriting algorithms — the company has managed to dial up the approval rates by approximately 50%. Further, Lendingkart was able to track the portfolio performance for early warning indicators as well as portfolio benchmarks. The model has also been continuously fed with any anomaly, industry changes and trends for training. “This has led to a loan book that is poised for balanced growth,” said Singh.

While the COVID pandemic resulted in delayed ITR filings and lowered efficacy of the credit bureau data, the ML-powered Cash Flow-based Lending System created a clear advantage, allowing the company to continue to use the model with best in class performance of the portfolio in the post lockdown period.

Wrapping Up

Lendingkart believes modern data mining techniques have led to better products and reduced the cost of financial products.

Currently, Lendingkart is developing a unique SaaS product for financial partners to offer financial products to untested credit customers. “This will be offered at reduced credit risk due to AI/ML backed data science models tested at scale, saving time and costs involved in the manual underwriting process,” said Singh. “The objective is to score every MSME in the country and address their working capital requirements leveraging the Lendingkart score.”

What Do You Think?